Advantus Legal Services

Licence Certifications.

-

Licence/Certifications

- GST Certificate

- MSME/Udyam Registration

- Import Export License

- FSSAI Food License

Additional Solutions

GST Certificate

What is GST

The goods and services tax (GST) is a value-added tax levied on most goods and services sold for domestic consumption. It is a destination based tax on consumption of goods and services. It is proposed to be levied at all stages right from manufacture upto final consumption with credit of taxes paid at previous stages available as set off. In a nutshell, only value addition will be taxed and burden of tax is to be borne by the final consumer.

The tax came into effect from July 1, 2017 through the implementation of One Hundred and First Amendment of the Constitution of India by the Indian Government. The tax replaced existing multiple Central and State Government taxes.

The tax rates, rules and regulations are governed by the GST Council which consists of the finance minister of central and all the states. GST is meant to replace a slew of indirect taxes with a unified tax and is therefore expected to reshape the country’s 2.4 trillion dollar economy. GST tax rates vary from 0% – 28% depending on the type of service or Nature of Goods Your business is selling. The GST is paid by consumers, but it is remitted to the government by businesses selling goods and services. In effect, GST provides revenue for the government.

Online GST Registration

GST (Goods and Services Tax) is essentially an Indirect tax which has been implemented to replace numerous taxes in India. Onlne GST registration was passed in the Parliament on 29th March 2017 yet it became effective on 1st July 2017 in India. As per the changes in the 32nd council meeting, the threshold limit for GST registration is 40 lakhs for the supplier of goods and 20 lakhs for the supplier of services. Along with that, the North-Eastern States have an option to choose between 20 lakhs and 40 lakhs. Once you have registered under this regime, you will receive a unique GSTIN (Goods and Service Tax Identification Number). There are various advantages of GST registration. You can also avail input tax credit and collect GST from recipients of goods and services.

Online GST registration can be easily done by visiting Online GST portal. It is easy to fill the form on GST online portal yet at the same time you require the expert’s to fill the form with accurate information and submit the documents accordingly. Few of the terms while drafting for GST registration cannot be understood by many of the taxpayers. Therefore at the initial stage GST registration should be done with the help of experts and here at Legaldocs, you will be able to get done with your GST registration with a simple and quick process.

Timeline

Day 1

Drafting, Payment and Document Upload

Our Team will consult you and help you with the drafting and Documents

Action Required by you

You need to fill up the simple form by logging in on LegalDocs website, make the payment after drafting. Upon Sucessful payment Document Upload section will be visible to the customer.

Action By Legaldocs

Legaldocs will Provide you free of cost consultation on eligibility, Documentation and Drafting

Day 2

Application Submission

Application will be submitted to GST Department with necessary details and documents. In this step TRN and ARN are generated.

Action Required by you.

You need to share OTP which you receive on your phone and Email ID.

Action By LegalDocs

We'll work diligently on your application and submit it to GST Department.

Day 9

Application Scrutiny

Application will be checked by GST authority in terms of proper documents and details.

Action Required by you

Just sit Back and Relax

Action By Legaldocs

We'll Follow up on the Application and Resolve queries Raised by GST Department

Day 10

Approval

Congratulations, your GST Registration is sucessful.

Action Required by you

You'll Receive a Mail From GST Department having Login ID and password. you need to Logi to the Portal and Download the GST Certificate

Action By Legaldocs

LegalDocs Will share a Link for your Review and Suggestion. Choose your filing packages as per your monthly invoices and we'll do the filing for you.

GST Calculator Online

GST was introduced in the year 2017 on 1st July, for the purpose to reduce the multiple taxes and build up a uniform tax in India. GST is segregated in four different types such as ;

- IGST (Integrated Goods and Services Tax)

- UTGST (Union Territory Goods and Services Tax)

- CGST (Central Goods and Services Tax)

- SGST (State Goods and Services tax).

GST registration is necessary for every taxpayer who falls under GST criteria. There are many (at least more than 5) GST slabs in India, and if you are trading/working in multiple GST Slab goods, you have to calculate values with/without GST. GST Calculator Online helps you to get either gross or net profit on GST rates. The GST calculator online spares time and reduces the mistake which can be done by humans while calculating the expense on Goods and Services.

List Of Documents Required For Registration

Current Account Opening

A current account is a type of deposit account that helps the professionals and businessmen to run their business. Businessmen can avail various benefits by Online Current Account such as:

- Unlimited transactions

- Customized features

- Online banking services

Online current account reduces the hassle and provides the benefit to complete the banking process anytime and anywhere.

Are You Ready To Grow Your Business?

- Zero Balance Current Account

- In just 5 mins

- Free Current Account Powered by —–

Benefits Of Registration

- You can legally collect taxes from your customers and pass on the Tax Benefits to suppliers.

- Business Becomes 100% tax Compliant

- You can Claim Input Tax Credit which you have paid on your purchases and improve profits.

- GST certificate can be used as one of the documents while opening current account or Business Account.

- You can easily apply for various states and Central Government tenders if you have GSTN.

- Expand your business through various channels like Online, Import-Exports

- To start payment gateways and use mobile wallets GST number is used.

What Are Different Types Of GST Registration?

- For the filing of GST, transactions need to be classified depending on the type of customer to whom the sale is done. Following are the two different types of GST registration:

A. Registration Under Composition Scheme:

The Composition Scheme is for the small taxpayers in order to ease the tax compliance for them. This scheme allows eligible taxpayers to pay a percentage of their yearly revenue as a tax. Like small retailers, eateries and trading businesses. This will relieve the taxpayers/ businesses from collecting taxes from their customers directly and adds benefits as mentioned below:

- File Single Quarterly return, not multiple monthly returns.

- Pay Lower Tax which gives competitive advantage

- Books of Accounts and Records are easy to maintain under GST norms.

In short, this is a customer who has a business which is registered under the composition scheme of GST and has a GSTIN.

Following is the eligibility criteria to register under GST Composition Scheme :

- Must be a Registered Taxpayer

- Annual Turnover should be less than Rs 1 Crore

- Manufacturers of Goods, Dealers, and Restaurants (Not Serving Alcohol) can opt for this scheme.

B. Registration As a Casual Taxable Person:

Casual Taxable Person is a person who supplies taxable goods or services occasionally like a event management company which has various events in different states needs to register as a Casual Taxable Person for that particular taxable state before supplying or offering any goods or services.

Suppose Mr. ‘A’ has a business of consulting and who provide services in different states, then he needs to register as a Casual Taxable Person so that his business is compliant with the tax norms of that particular state.

Package Includes

- GST Certificate

- GST invoice Template

- GST Offline Invoice Software

- GST HSN Codes and Tax Rates

Who Needs GST Registration Number?

- Businesses having annual turnover morethan Rs 20 Lakhs Per Annum (Rs 10 Lakh for North Eastern States)

- If business is dealing in more than one state

- If your business has previous registration under VAT, Excise Laws, Service Tax Laws

- Selling your goods or services online (like selling on Amazon and Flipkart)

- If you are providing services and goods outside India.

Penalties Involved Under GST Act

Not having GST Registration : 100% tax Due or Rs10,000. Whichever is higher

Not giving GST invoice : 100% tax due or Rs10,000. Whichever is higher

Incorrect Invoicing : Rs 25,000

Not filing GST Tax Returns : For Nil Return its Rs 20 Per Day, Regular Returns Rs 50 Per Day.

Choosing Composition Scheme even if not eligible : 100% tax due or Rs10,000. Whichever is higher

MSME/Udyam Registration

Udyam Registration

The Union Ministry of Micro, Small and Medium Enterprises (MSME) has introduced a new process of classification and registration of MSME Enterprises under the name of ‘Udyam Registration’ on July 01, 2020.

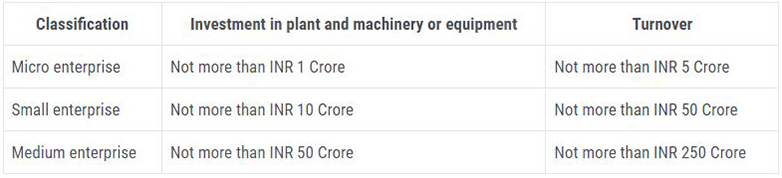

Revised MSME Classifications

A micro, small and medium enterprise (MSME) is classified as below-

Who Should Apply For Online Udyam Registration?

Any person who intends to establish a micro, small, medium enterprise may file online udyam registration.

Documents Required For Udyam Registration Online

The Online Udyam Registration application process is based on self-declaration, and there is no further requirement to upload any documents, certificates, papers, or proofs.

The user will only need to provide their 12-digit Aadhaar Number, Pan Card and Bank Account details of Business for the registration process.

Udyam Registration Process

You can carry out the Udyam Registration iby simply logging on to LegalDocs website and follow the below mentioned 3 easy steps.

1.Application Drafting

Submit the Application and Make the payment

2.Processing

Our CA will File the Application Online

3.Certificate

Once Approved You will Receive MSME Certificate on Your Registered E-mail Address

How To Register MSME Usign Udyam Registration Portal?

The new MSME registration process is completely online, paperless and based on self-declaration. No documents or proofs are required to be uploaded for registering an MSME.

- An MSME needs to apply for online Udyam Registration in Udyam Registration Portal.

- On successful submission of application, the enterprise will be assigned ‘Udyam Registration Number’ (i.e., permanent identity number).

- On completion of the registration process, the enterprise shall be issued a ‘Udyam Registration Certificate’.

- Aadhaar number is mandatory for obtaining udyam registration. Following aadhaar number is required based on the type of firm

Udyam Registration For Existing MSME Businesses/ Enterprises

The existing enterprises registered either under EM-Part – II or UAM or registered with any other organization under the Ministry of Micro, Small and Medium Enterprises are required to register again on the Udyam Registration Portal. Such enterprises are required to apply and obtain Udyam Registration on or after 1st July 2020.

The enterprises registered prior to 30th June 2020 should note the following points-

- Such enterprises shall be re-classified based on the revised criteria notified under notification dated 26th June 2020;

- Such enterprises registered prior to 30th June 2020 shall be valid only till 31st March 2021

Udation Of Information In Udyam Registration

The enterprise already having the Udyam registration number needs to update its information online on the Udyam Registration Portal. In case of failure, the enterprise would be liable for suspension of its status.

The classification of the enterprise shall be updated based on the information collected from the income tax return or the goods and service tax return. The updation, if any, and its consequence are explained hereunder

Udyam Registration Benefits

Following are some of the benefits of Udyam Registration

- Easy Bank Loan upto 1 Cr without Collateral/ Mortgage

- Special Preference in Procuring Government Tenders

- 1 percent Exemption on interest rate on Bank Overdraft (OD)

- Concession in Electricity Bills

- Protection against the delay in payment from Buyers

- Tax Rebates

- Special 50 percent discount on Government fees for Trademark and Patent

- Fast Resolution of Disputes

Import Export License

Why Choose Legadocs

- Lowest Price Guarantee

- No Office Visit, No Hidden Cost

- Serviced 50000+ Customers

What IS ICE?

If you are in business of Importing and Exporting of goods in India, it mandatory to have 10 digit Import Export Code. Many a times Import Export Code is abbreviated as IEC. Import Export Code is required for all persons or enterprises involved in Import or Export of goods. Import Export Code is issued by the Directorate General of Foreign Trade (DGFT), Ministry of Commerce and Industries, Government of India. Import Export Code has Lifetime Validity.

Timeline

Day 1

Form Filling Payment and Document Upload

Our Team will consult you and help you with the drafting and Documents

Action Required by you

You need to fill up the simple form by logging in on LegalDocs website, make the payment after drafting. Upon Sucessful payment Document Upload section will be visible to the customer.

Action By Legaldocs

We'll start the Application Process

Day 2

Application Submission

Application Will Be Processed and Submitted to IEC Authority

Action Required by you

You just sitback and relax

Action By Legaldocs

Application Submission

Day 7

Approval and Delivery

Application will be checked and approved in 5 working days

Action Required by you

Congratulation's Your Import export code is approved, now you can start your international trade.

Action By Legaldocs

We'll update you Once the application is approved you will receive the digital copy on your E-mail ID.

Document Requirements For IC Code

The new MSME registration process is completely online, paperless and based on self-declaration. No documents or proofs are required to be uploaded for registering an MSME.

- An MSME needs to apply for online Udyam Registration in Udyam Registration Portal.

- On successful submission of application, the enterprise will be assigned ‘Udyam Registration Number’ (i.e., permanent identity number).

- On completion of the registration process, the enterprise shall be issued a ‘Udyam Registration Certificate’.

- Aadhaar number is mandatory for obtaining udyam registration. Following aadhaar number is required based on the type of firm

IEC Process

Process Takes around 5-7 working days once complete Documents shared.

Benefits Of ICE

- Open International Market IEC helps you in taking your organization and products to the worldwide market and develop your organizations. You can also sell your products on international platforms

- Product scaling and Increased Revenue there will be a vast increase in the revenue of the organization

- Several benefits are availed the organization and various companies can avail several benefits from DGFT, customs, etc as per the IEC registration. On Exports the organization can claim tax benefits as well

- Filing of return is not required IEC does not require the recording of any profits. When allocated, there isn’t any necessity to pursue any kind of procedures for supporting its legitimacy. Notwithstanding for fare exchanges, there isn’t any necessity for recording any profits with DGFTEasiest procedure It is genuinely simple to acquire IEC code from the DGFT inside a time of 10 to 15 days subsequent to presenting the application. There isn’t any need to give a proof of any fare or import for getting IEC code

- No need of any renewal IEC code is successful for the lifetime of a substance and requires no recharging. It could also be utilized by a substance against all fare and import exchanges

When You Require IEC

- If an importer needs to clear his shipments from the traditions at that time IEC is required by the traditions experts

- When in importer sends cash to another country through banks at that point IEC is required by the bank

- At the point when an exporter needs to send his shipments then its required by the traditions port

- When an exporter receives foreign currency in his bank account, IEC is required

Cases Where Imort Export Code Is Not Requured

- As per the latest circular passed by the government it is declared that every trader do not require IEC if they have registered themselves under GST (Goods and Services Tax). In such cases the PAN card will be used as new IEC code for importing and exporting goods

- IEC is not required until and unless you import goods for commercial use. As well as Charitable institutions do not require IEC

- If you are looking to expand your market and go beyond country borders and export/import, reach out to our experts and know all formalities you need to get through. You can avail all services such as GST registration, business registration etc.

Needs Of IEC

LegalDocs is India biggest Import Export Code Agent serving customers across India.

- Importer need IEC License for custom clearance.

- Exporters need IEC License for export subsidy.

- Bank requires IEC License for sending and receiving money to foreign customers.

- For Food Licensing and APEDA Licensing IE Code is Required.

FSSAI Food License

What Is Foscos FSSAI Full Form Or FSSAI Meaning?

FoSCoS – FSSAI full form is the Food Safety Compliance System (FoSCoS) – Food Safety and Standards Authority of India (FSSAI) which is an autonomous body established under the Ministry of Health & Family Welfare, Government of India.

Whats Is FSSAI Registration (FOOD LICENSE)

FSSAI – Food Safety and Standards Authority of India is an autonomous body established under the Ministry of Health & Family Welfare, Government of India. The FSSAI has been established under the Food Safety and Standards Act, 2006 which is a consolidating statute related to food safety and regulation in India. It is an organization that monitors and governs the food business in India. FSSAI License is responsible for protecting and promoting public health through the regulation and supervision of food safety.

FSSAI License or FSSAI Registration is mandatory before starting any food business. FSSAI Registration is required for all food related businesses such as manufacturers, traders, restaurants, small eateries, grocery shop, importers, exporters, home based food businesses, dairy farms, processors, retailers, e-tailers . who are involved in food business must obtain a 14-digit registration Number or a Food license number which must be printed on food packages or Displayed in Premises. This 14 digit FSSAI license number gives data about the producer’s permit or enrollment subtle elements, and the assembling state.

What Is FOSCOS FSSAI?

FSSAI launched Food Safety Compliance System (FoSCoS) wef 1st June 2020 replacing the existing Food Licensing and Registration System. This system replaces the existing online Food Licensing and Registration System (FLRS: https://foodlicensing.fssai.gov.in ). Users of these States/UTs are now required to visit https://foscos.fssai.gov.in. The technology on which the FLRS was built was outdated with technical support no longer available. Thus the migration from FLRS to FoSCoS was mandatory.

Food License Registration certificate is required to run a food product business. You have to register under Food Safety and Standards Authority of India (FSSAI) to manufacture, distribute and transport food products. FSSAI is established under the Ministry of Health & Family Welfare, Government of India. The FSSAI has been established under the Food Safety and Standards Act, 2006. FSSAI Certificate and FSSAI License are the same which ensures the quality, purity and other important factors the customers can rely upon.

The FoSCoS offers licensing, registration, inspection and annual return modules for food business operators (FBO’s). It is a one-point stop for any regulatory compliance transaction for all FBO’s.

What Is FSSAI Registration Free Of Cost

As per the Food Safety and Standards (Licensing & Registration of Food Businesses) Regulations, 2011, the guidelines were laid down regarding the fee structure for the Food Business Operators.

The food business in India are required to get done with FSSAI registration, in case any of the food business operators fail to do so has to pay penalty for the same.

FSSAI Registration Fee is partitioned into the government expense and expert expense. Government expense formally charged by the govt for the application handling charge and an expert charge is charged by the Professional to set up your application.

FSSAI registration is segregated in three different types such as Basic registration, State registration and Central registration, the FSSAI fees for these registrations are mentioned below:

1) Basic FoSCoS FSSAI License – Fees

Annual turnover below 12 lakhs – 100/- per year

2) State FoSCoS FSSAI License – Fees

Annual turnover above 12 lakhs and below 20 crores – 2000/- or 5000/- per year

3) Central FoSCoS FSSAI License – Fees

Annual turnover above 20 crores – 7500/- per year

Easy Steps For FSSAI Licence

1.Consultation

Get a free FSSAI Licence consultation from our experts

2.Documents

Upload Documents Online, from anywhere anytime

3.Approval

Easy and secure online approval

4.Delivery

Get you food license/certificate at your home

Timeline For FSSAI Registration

Day 1

Drafting, Payment and Document Upload

Our Team will consult you and help you with the drafting and Documents

Action Required by you

You need to fill up the simple form by logging in on LegalDocs Website, choose number of years for which you need License and make the payment. Upon Sucessful payment Document Upload section will be visible to the customer.

Action By Legaldocs

Legaldocs will Provide Food Licence consultation and form filling free of cost.

Day 2

Application Submission

Application Will Be submiited to FSSAI with Necessary Government Payment

Action Required by you

You Just need to Sitback and Relax we'll submit the application

Action By Legaldocs

We'll work diligently on your application and Submit it to FSSAI

Day 45-59

Scrutiny and Inspection

Inspection Will be done by FSSAI Authority for state and central Licenses inspection is not applicable in case of Basic Registration,

Action Required by you

Just Sitback and Relax

Action By Legaldocs

We'll Follow up on the Application and Resolve queries Raised by Designated Officer

Document Required For FSSAI Registration

For Basic FSSAI Registration

How To Apply For FSSAI Registration

FSSAI Registration can be applied online however it constantly required the expert to present your application. So here is a simplified procedure for FSSAI Application.

1) FSSAI registration procedure is started by submitting Form A (application) to food and security office.

2) This application can be acknowledged or it might be dismissed by the Department inside 7 days from the application date and the reality must be hinted to the candidate recorded as a hard copy

3) On the off chance that the application is acknowledged, at that point, the division will allow a registration authentication with the enlistment number and the photograph of the candidate.

What Are The Advantages Of Obtaining FSSAI Food License?

- The food business can get several legal benefits

- Creates consumer awareness

- You can use FSSAI logo, which can build a goodwill among the customers.

- Set down science-based principles

- Regulate manufacture, storage, distribution, sale and import of food

- To facilitate food safety

- The research and development sector is responsible to maintain the safety.

- New guidelines are introduced which are compatible with international organization

- Set up evidence proof studies for building policies.

- There is a huge chance of business expansion.

Laying down procedure and guidelines for notification of the accredited laboratories as per ISO17025 for quality assurance is also responsibility of FSSAI.

What Are The Types Of FSSAI License

The three licenses, differ on the basis of the scale of operation of the food business which is being carried out. The following is the detailed information on the three food licenses.

Basic FoSCoS FSSAI Registration

If the annual turnover of a food business is below Rs. 12 lakh then basic registration of food licensing is required. Generally when someone is starting up a business and unsure of expected turnover, basic food safety registration is done which can be upgraded to state license if the turnover exceeds Rs. 12 Lakh.

Dairy having capacity less that 500 liters per day or daily manufacturing capacity less than 100kg per day needs to get basic FSSAI registration which includes wide range of businesses starting from small pan shops, tea stalls, home based food operators, small warehouses, canteen’s , mid day meal services and food processors. The maximum tenure of this license is 5 years and the minimum is 1 year.

State FoSCoS FSSAI License

If the annual turnover of the food business is more than Rs. 12 lakhs and less than Rs. 20 crores then one has to get state FSSAI License.

Manufacturing units having capacity upto 2 MT per day, Dairy units handling business upto 50000 liters per day, 3 star hotels and above, repackers and relebelling units, clubs canteens, all the catering business irrespective of their turnover needs to apply for State licence. The maximum tenure of this license is 5 years and the minimum is 1 year.

Central FoSCoS FSSAI License

If the annual turnover of the food business is more than Rs. 20 Crores then central FSSAI License is required.

Now the businesses which do not fall under the above two Additional Solutions, they need to go for central licence, the importer and exporters mandatorily needs central licence, in case you are in a business having multiple outlets across the country then you need to go for central licence for your registered address and also need to get basic state or central licences depending on the turnover of each outlet. The maximum tenure of this license is 5 years and the minimum is 1 year.

FSSAI REGISTRATION FORM

The FSSAI required reports for Food License relies upon what sort of registration you require like, Simple Registration Form A or Food License Form B. Regardless of whether you require Form A or Form B currently relies upon your yearly turnover.

FSSAI Registration Form A

Basic FSSAI Registration Form A is needed to be filed when the small FBO has an annual turnover of less than 12 lakhs.

FSSAI Registration Form B

FSSAI LICENSE VALIDITY

FSSAI license validity reaches out from 1 to 5 years and it relies on the number of years which is picked by the nourishment administrator. The expense of the permit anyway increments with the number of years which he has connected for. According to the FSSAI rules, the food business operator needs to apply for the renewal of the license in 30 days and it should be done before its expiry. Any FSSAI Renewal Application filed beyond the expiry date is subjected to a late fee of Rs.100 for each delayed day.

FSSAI RENEWAL

In India, FSSAI registration or Food License is fundamental for every food business operator before starting the food business. FSSAI License is similarly imperative to be renewed within the time period or before it expires.

The food license issued to the food business operator can have a validity of 1 year or up to 5 years. FSSAI registration fees vary as per tenure of the FSSAI License. As per the FSSAI rules, each food business operator needs to apply for FSSAI renewal 30 days before the expiry of the current food license.

Penalty on FSSAI Licence Renewal: If the application for FSSAI License (state and Central) renewal isn’t documented in the stipulated time, then Rs. 100 per day would be fined for FSSAI Licences.

Penalty on FSSAI Registration Renewal: If Renewal of Food registration isn’t done within the stipulated time then it will be considered as a gap and a new license would need to be applied by the food business operator to continue the business further.

The License or FSSAI registration will keep on being in power till time arranges on the FSSAI renewal application are passed that must be past 30 days from the date of expiry of FSSAI license.

POINTS TO KEEP IN MIND WHILE FSSAI LICENSE RENEWAL

- The Food License issued to the FBO will be placed in the Renewal Bin before 120 days of expiry. FBOs need to apply for renewal when their license shows up in the renewal bin.

- If there is an arising of delay, a punishment of ₹ 100/day will be charged on the Food Business Operator.

- Non – Renewal of the FSSAI or food license could lead a punishment.

- The extension of the renewal is also for 1 to 5 years. The cost of renewing will also increase depending on the extension period.

WHAT IS FOOD AND SAFETY DEPARTMENT OR REGISTRATION

FSSAI has presented an online application called Food Licensing and Registration System (FLRS) so business visionaries related to food can apply online for the FSSAIlicense. This Food Licensing and Registration System is utilized by five Regional Offices of FSSAI in New Delhi for the Northern Region, in Kolkata for the Eastern Region, in Guwahati for North Eastern Region, Mumbai for the Western Region and Kerala for the Southern Region And in Chennai, Food Business Operators (FBO) is issued to issue licenses and enlistment. FLRS checks for the eligibility of food-related business based on their business area and the sort of procedure identified with the business person.

Design Registration

What Is Foscos FSSAI Full Form Or FSSAI Meaning?

FoSCoS – FSSAI full form is the Food Safety Compliance System (FoSCoS) – Food Safety and Standards Authority of India (FSSAI) which is an autonomous body established under the Ministry of Health & Family Welfare, Government of India.

Whats Is FSSAI Registration (FOOD LICENSE)

FSSAI – Food Safety and Standards Authority of India is an autonomous body established under the Ministry of Health & Family Welfare, Government of India. The FSSAI has been established under the Food Safety and Standards Act, 2006 which is a consolidating statute related to food safety and regulation in India. It is an organization that monitors and governs the food business in India. FSSAI License is responsible for protecting and promoting public health through the regulation and supervision of food safety.

FSSAI License or FSSAI Registration is mandatory before starting any food business. FSSAI Registration is required for all food related businesses such as manufacturers, traders, restaurants, small eateries, grocery shop, importers, exporters, home based food businesses, dairy farms, processors, retailers, e-tailers . who are involved in food business must obtain a 14-digit registration Number or a Food license number which must be printed on food packages or Displayed in Premises. This 14 digit FSSAI license number gives data about the producer’s permit or enrollment subtle elements, and the assembling state.

What Is FOSCOS FSSAI?

FSSAI launched Food Safety Compliance System (FoSCoS) wef 1st June 2020 replacing the existing Food Licensing and Registration System. This system replaces the existing online Food Licensing and Registration System (FLRS: https://foodlicensing.fssai.gov.in ). Users of these States/UTs are now required to visit https://foscos.fssai.gov.in. The technology on which the FLRS was built was outdated with technical support no longer available. Thus the migration from FLRS to FoSCoS was mandatory.

Food License Registration certificate is required to run a food product business. You have to register under Food Safety and Standards Authority of India (FSSAI) to manufacture, distribute and transport food products. FSSAI is established under the Ministry of Health & Family Welfare, Government of India. The FSSAI has been established under the Food Safety and Standards Act, 2006. FSSAI Certificate and FSSAI License are the same which ensures the quality, purity and other important factors the customers can rely upon.

The FoSCoS offers licensing, registration, inspection and annual return modules for food business operators (FBO’s). It is a one-point stop for any regulatory compliance transaction for all FBO’s.

What Is FSSAI Registration Free Of Cost

As per the Food Safety and Standards (Licensing & Registration of Food Businesses) Regulations, 2011, the guidelines were laid down regarding the fee structure for the Food Business Operators.

The food business in India are required to get done with FSSAI registration, in case any of the food business operators fail to do so has to pay penalty for the same.

FSSAI Registration Fee is partitioned into the government expense and expert expense. Government expense formally charged by the govt for the application handling charge and an expert charge is charged by the Professional to set up your application.

FSSAI registration is segregated in three different types such as Basic registration, State registration and Central registration, the FSSAI fees for these registrations are mentioned below:

1) Basic FoSCoS FSSAI License – Fees

Annual turnover below 12 lakhs – 100/- per year

2) State FoSCoS FSSAI License – Fees

Annual turnover above 12 lakhs and below 20 crores – 2000/- or 5000/- per year

3) Central FoSCoS FSSAI License – Fees

Annual turnover above 20 crores – 7500/- per year

Easy Steps For FSSAI Licence

1.Consultation

Get a free FSSAI Licence consultation from our experts

2.Documents

Upload Documents Online, from anywhere anytime

3.Approval

Easy and secure online approval

4.Delivery

Get you food license/certificate at your home

Timeline For FSSAI Registration

Day 1

Drafting, Payment and Document Upload

Our Team will consult you and help you with the drafting and Documents

Action Required by you

You need to fill up the simple form by logging in on LegalDocs Website, choose number of years for which you need License and make the payment. Upon Sucessful payment Document Upload section will be visible to the customer.

Action By Legaldocs

Legaldocs will Provide Food Licence consultation and form filling free of cost.

Day 2

Application Submission

Application Will Be submiited to FSSAI with Necessary Government Payment

Action Required by you

You Just need to Sitback and Relax we'll submit the application

Action By Legaldocs

We'll work diligently on your application and Submit it to FSSAI

Day 45-59

Scrutiny and Inspection

Inspection Will be done by FSSAI Authority for state and central Licenses inspection is not applicable in case of Basic Registration,

Action Required by you

Just Sitback and Relax

Action By Legaldocs

We'll Follow up on the Application and Resolve queries Raised by Designated Officer

Document Required For FSSAI Registration

For Basic FSSAI Registration

How To Apply For FSSAI Registration

FSSAI Registration can be applied online however it constantly required the expert to present your application. So here is a simplified procedure for FSSAI Application.

1) FSSAI registration procedure is started by submitting Form A (application) to food and security office.

2) This application can be acknowledged or it might be dismissed by the Department inside 7 days from the application date and the reality must be hinted to the candidate recorded as a hard copy

3) On the off chance that the application is acknowledged, at that point, the division will allow a registration authentication with the enlistment number and the photograph of the candidate.

What Are The Advantages Of Obtaining FSSAI Food License?

- The food business can get several legal benefits

- Creates consumer awareness

- You can use FSSAI logo, which can build a goodwill among the customers.

- Set down science-based principles

- Regulate manufacture, storage, distribution, sale and import of food

- To facilitate food safety

- The research and development sector is responsible to maintain the safety.

- New guidelines are introduced which are compatible with international organization

- Set up evidence proof studies for building policies.

- There is a huge chance of business expansion.

Laying down procedure and guidelines for notification of the accredited laboratories as per ISO17025 for quality assurance is also responsibility of FSSAI.

What Are The Types Of FSSAI License

The three licenses, differ on the basis of the scale of operation of the food business which is being carried out. The following is the detailed information on the three food licenses.

Basic FoSCoS FSSAI Registration

If the annual turnover of a food business is below Rs. 12 lakh then basic registration of food licensing is required. Generally when someone is starting up a business and unsure of expected turnover, basic food safety registration is done which can be upgraded to state license if the turnover exceeds Rs. 12 Lakh.

Dairy having capacity less that 500 liters per day or daily manufacturing capacity less than 100kg per day needs to get basic FSSAI registration which includes wide range of businesses starting from small pan shops, tea stalls, home based food operators, small warehouses, canteen’s , mid day meal services and food processors. The maximum tenure of this license is 5 years and the minimum is 1 year.

State FoSCoS FSSAI License

If the annual turnover of the food business is more than Rs. 12 lakhs and less than Rs. 20 crores then one has to get state FSSAI License.

Manufacturing units having capacity upto 2 MT per day, Dairy units handling business upto 50000 liters per day, 3 star hotels and above, repackers and relebelling units, clubs canteens, all the catering business irrespective of their turnover needs to apply for State licence. The maximum tenure of this license is 5 years and the minimum is 1 year.

Central FoSCoS FSSAI License

If the annual turnover of the food business is more than Rs. 20 Crores then central FSSAI License is required.

Now the businesses which do not fall under the above two Additional Solutions, they need to go for central licence, the importer and exporters mandatorily needs central licence, in case you are in a business having multiple outlets across the country then you need to go for central licence for your registered address and also need to get basic state or central licences depending on the turnover of each outlet. The maximum tenure of this license is 5 years and the minimum is 1 year.

FSSAI REGISTRATION FORM

The FSSAI required reports for Food License relies upon what sort of registration you require like, Simple Registration Form A or Food License Form B. Regardless of whether you require Form A or Form B currently relies upon your yearly turnover.

FSSAI Registration Form A

Basic FSSAI Registration Form A is needed to be filed when the small FBO has an annual turnover of less than 12 lakhs.

FSSAI Registration Form B

FSSAI LICENSE VALIDITY

FSSAI license validity reaches out from 1 to 5 years and it relies on the number of years which is picked by the nourishment administrator. The expense of the permit anyway increments with the number of years which he has connected for. According to the FSSAI rules, the food business operator needs to apply for the renewal of the license in 30 days and it should be done before its expiry. Any FSSAI Renewal Application filed beyond the expiry date is subjected to a late fee of Rs.100 for each delayed day.

FSSAI RENEWAL

In India, FSSAI registration or Food License is fundamental for every food business operator before starting the food business. FSSAI License is similarly imperative to be renewed within the time period or before it expires.

The food license issued to the food business operator can have a validity of 1 year or up to 5 years. FSSAI registration fees vary as per tenure of the FSSAI License. As per the FSSAI rules, each food business operator needs to apply for FSSAI renewal 30 days before the expiry of the current food license.

Penalty on FSSAI Licence Renewal: If the application for FSSAI License (state and Central) renewal isn’t documented in the stipulated time, then Rs. 100 per day would be fined for FSSAI Licences.

Penalty on FSSAI Registration Renewal: If Renewal of Food registration isn’t done within the stipulated time then it will be considered as a gap and a new license would need to be applied by the food business operator to continue the business further.

The License or FSSAI registration will keep on being in power till time arranges on the FSSAI renewal application are passed that must be past 30 days from the date of expiry of FSSAI license.

POINTS TO KEEP IN MIND WHILE FSSAI LICENSE RENEWAL

- The Food License issued to the FBO will be placed in the Renewal Bin before 120 days of expiry. FBOs need to apply for renewal when their license shows up in the renewal bin.

- If there is an arising of delay, a punishment of ₹ 100/day will be charged on the Food Business Operator.

- Non – Renewal of the FSSAI or food license could lead a punishment.

- The extension of the renewal is also for 1 to 5 years. The cost of renewing will also increase depending on the extension period.

WHAT IS FOOD AND SAFETY DEPARTMENT OR REGISTRATION

FSSAI has presented an online application called Food Licensing and Registration System (FLRS) so business visionaries related to food can apply online for the FSSAIlicense. This Food Licensing and Registration System is utilized by five Regional Offices of FSSAI in New Delhi for the Northern Region, in Kolkata for the Eastern Region, in Guwahati for North Eastern Region, Mumbai for the Western Region and Kerala for the Southern Region And in Chennai, Food Business Operators (FBO) is issued to issue licenses and enlistment. FLRS checks for the eligibility of food-related business based on their business area and the sort of procedure identified with the business person.

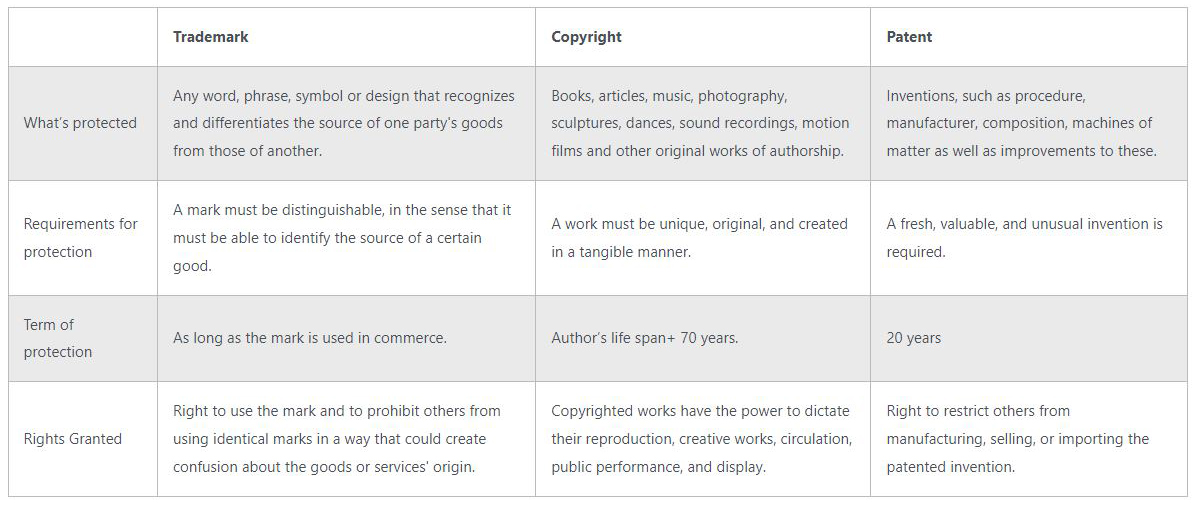

Trademark vs Copyright vs Patent